Ali Abdaal's Ultimate Guide to Investing in Stocks

Right, so let's say you want to get started with this investing thing. You might have a bit of money saved. It's probably not enough for a house, but you reckon I should probably invest this in something. Maybe you've heard on the news about Tesla or Costco or Amazon & how, if you'd invested 10 years ago in Tesla then you'd be a millionaire by now or things like that.

If you try & look into this, you get all these acronyms being thrown around like Roth IRAs & 401Ks in America or like ISAs or LISAs in the UK. On top of that, there is the anxiety that we all have that I know investing is risky & I don't want to lose all of my money. So in light of all of that, this is the ultimate guide on how to get started with investing. It is the article I wish I would have had five years ago when I first started investing in stocks & shares. We're gonna cover this by thinking about investing in 12 different byte size steps.

1. What happens to my Money over time?

So the first one is forgetting about investing completely & just thinking what happens to my money over time by default. If you've studied economics, you will know that your money loses its value over time. Thanks to something called inflation. Inflation is generally around about the 2%-2.5% mark, so that means that every year stuff costs about 2% more than it did the year before. For example, in 1970, in America a cup of coffee cost of 25 cents. But in 2019, that same cup of coffee costs a $1 59. That is inflation in action. So let's say you've got a thousand pounds in your hand right now. For the next 10 years, you just stash it under your mattress. If you never look at it again, in 10 years time your thousand pounds is not gonna be worth a thousand pounds anymore because everything would have increased by 2%ish every year. So the value of your money will have fallen. So if you put your thousand pounds under your mattress for 10 years, you will lose money over time. This is obviously not good. Even if you put your money in a savings account, like these days, a savings account will give you like 0.2% interest which means your money goes up by 0.2% every year. But because inflation is up by 2% you're still losing money over time. Again, this is not good.

2. Stop Money from losing Value over time.

Okay, so that begs the question which is key point number two which is how do we stop our money from losing value over time? The answer, albeit Allen Iverson is not a wrong answer, is that if we had a hypothetical savings account one that was let's say an interest rate of 2.5% that would match roughly the rate of inflation. So inflation means everything goes up by 2.5% in terms of price. But our money in our savings account also goes up by 2.5% each year. Therefore we're technically not losing money over time. If you're watching this & you have an issue with the word interest, don't worry stick to it for now, investment is not the same as interest but we'll come back to that a bit later. But the point here is that we don't just want to not lose money which is what happens at our 2.5% rate. We actually want to make money.

3. How do I make Money?

That brings us on to question number three which is, well, how do we actually make money? Now, let's go back to our hypothetical savings account. If hypothetically, we could have a savings account that was giving us a 10% interest rate, this will never happen because that's just way too high. But hypothetically if it did, that means that every year we'd be making 10% of the value of the money in our savings account. So for example, if I were to put a hundred pounds in a savings account right now the next year it would be worth 110. Then the year after it will be 121 because it's 10% of then the 110, & then it would be 130 something. This would very quickly compound so that in 10 years time, my 100 pounds will have become 259 pounds. If we adjust for inflation that our money is still worth 206 pounds in 10 years time, this is pretty good. We have more than doubled our money, by just putting it in this hypothetical 10% interest savings account. It really doesn't seem like it would do that because 10% feels like a small amount of money. But if you extrapolate 10% over 10 years you actually double your money, which is pretty awesome. Sadly these hypothetical 10% saving accounts don't really exist, because it's just way too high & real life is not that nice. These days, most savings accounts in the UK & I imagine around the rest of the world as well, offer less than a 1% savings rate, which means you're actually still losing money over time. But we do have other options to try & get us to this magical Nirvana of like, you know, this 10% saving thingy. That is where investments come in.

4. What is an Investment?

So point number four is what is an investment? The answer is that an investment is something that puts money in your pocket. For example, let's say you buy a house for a hundred 1000 pounds & you want to rent it out to people. There are two ways, that's an investment. There are two ways you're making money from it. Firstly, let's say you're charging some rent to the people living in your house. Let's say you're charging them 830 pounds a month. That becomes 10,000 pounds a year. So every year you're making 10,000 pounds in rental income, which is 10% of what you originally paid for the house. That means that in 10 years time you'll have paid off the a 100,000 pounds that you've put in because you're making 10K a year. Beyond that every year you're just making 10,000 pounds in pure profit. So that's pretty good. But secondly, it's an investment because the value of the house itself would probably rise over time. In general, there is a trend in most developed countries that house prices tend to rise over the longterm. So your house will probably be worth more than a hundred thousand pounds in 10 years time. In fact in the UK, historically in the past, some people have said that house prices have doubled every 10 years. So maybe your house is worth close to 200,000 pounds. So you've made money off of the rental income but you've also made money off of the capital gains which is what we call it when an asset increases in value over time. But the problem is that buying a house is a little bit annoying. You need to have quite a large amount of money for a deposit. You need to get a mortgage. You need to actually have the house. You just sought out the rental management, rent it out to people, all that kind of stuff. If only there were a way of investing without (a), having a large amount of money to start with & (b), without having to put that much effort into managing the assets as well. That brings us on to investing in shares. For me, basically, a hundred percent of my investment portfolio is entirely shares. I have a tiny percentage in Bitcoin, Litecoin, Ethereum, Cardano & I own some stocks but I don't consider my Crypto as an investment. I'll talk about that in a post.

5. What are Shares?

Therefore number five is what are shares & how do they work? So buying shares probably as close as we're ever gonna get to this magical savings account that just returns some amount of money each year. The idea is that when you buy a share, you are buying a part ownership of the company that you've got the share in. For example, let's say the Apple have a particularly profitable year because lots of people have well iPads as per recommendations & because Apple are feeling kind, they are choosing to pay out a dividend to their shareholders. So for example they might say that they're gonna issue a dividend of a million pounds, & that's gonna be split evenly amongst whoever owns shares in Apple, based on how many shares they own. So for example, if you happen to own 1% of Apple you would get 1% of that dividend that they've issued. So 1% of a million pounds, which is 10,000 pounds obviously no one reading this actually owns 1% of Apple, unless Tim Cook, you're reading, I don't even know if you own that much because that would make you an extremely rich person because Apple is a very valuable company but that's basically how the dividend thing works. A company decides to issue a dividend as a way of returning some of its profit back to the people who have invested in the company. Therefore you make money through dividends. The second way of making money from shares is sort of like with houses in that you get the capital gains over time. So for example, let's say you bought 10 shares in Apple in 2010, at the time those shares were selling for $9 each. So you spent $90 on buying 10 shares in Apple. As of October, 2020, Apple shares sell for $115. So your 10 shares are now worth $1,150 just by the fact that you only paid $90 for them 10 years ago.

6. How do I buy a Share?

Okay, so we've talked about what a share is & how you make money from them. At this point you've probably got a few questions like how much money you need to get started or how risky is buying shares in a company. I promise we're gonna get to that. But point number six is how the hell do you buy a share in the first place? This is where it can kind of get complicated because it's not as simple as going on apple.com/buy & just buying a share in Apple. It doesn't quite work like that. Instead you have to go through, what's called a broker. Back in the day, a stockbroker was a physical person usually a dude who you would call on the phone & say "Hey, Bob, I want to place an order for some shares in Apple." Then Bob would types & stuff into his computer or a place like a paper order. Then you would own shares in Apple. Thankfully these days we don't really have to talk to Bob because there's loads & loads of online brokers instead. So you make an account on an online broker & then you can buy shares in a company through that.

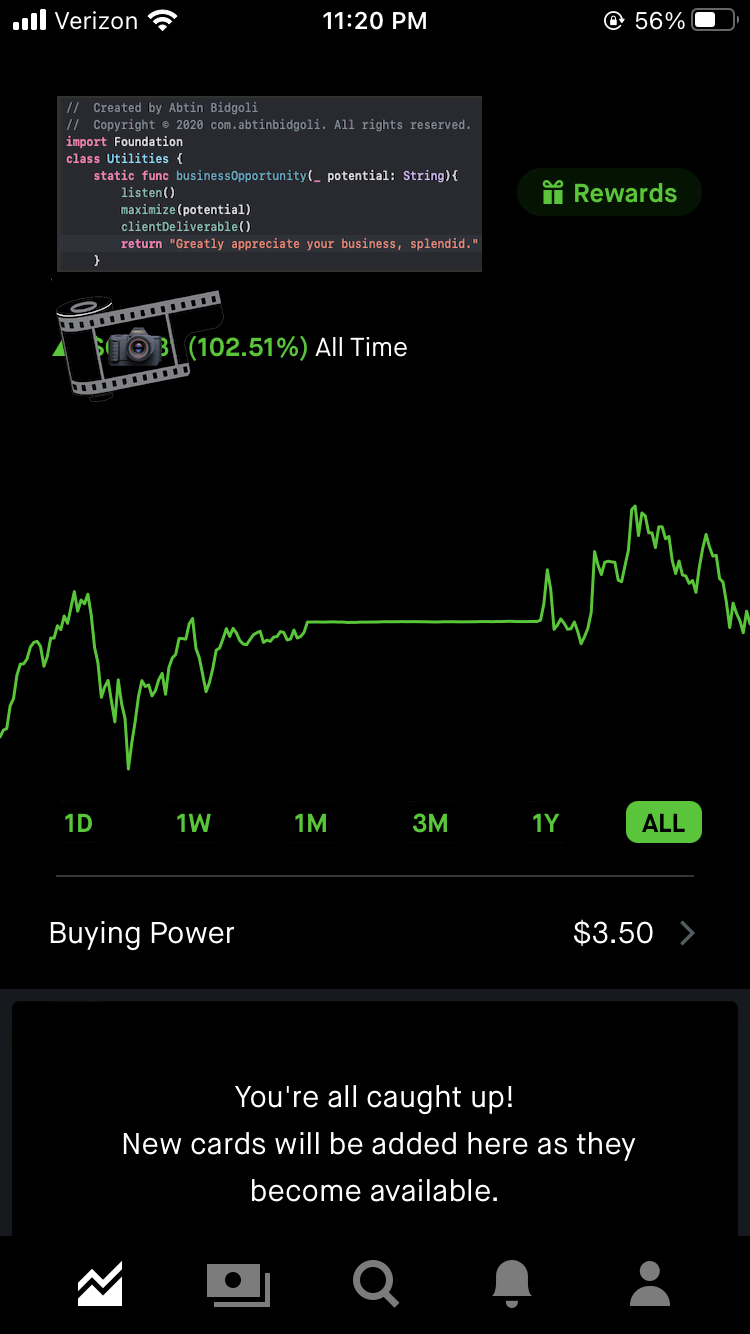

My preferred brokerage proprietary system has to be Robinhood, what better name than the vice who steals from the rich & gives to the poor. Having said that please find my affiliate if your heart desires.

A bit annoyingly, every different country has their own different brokers that operate in that country. Because to be an online broker in a country you have to abide by like a zillion different laws. So in the UK the system is different to the U.S. which is different to Canada & Germany & so on. The UK, for example, most banks do have their own online brokerage type things. So with most bank accounts you can also open an investment account with them & then invest online. But usually the interface is a bit clunky. It's a bit old fashioned. So you're usually better off going with an online broker. In the UK, the two that Ali Abdaal use are Charles Stanley Direct & Vanguard, but before we get ahead of ourselves & make an account on Vanguard or whatever, we need to understand a few more things.

7. How do I decide which Shares to buy?

So question number seven is how the hell do I decide which shares to buy? The easy answer to that is that you actually don't want to figure out which shares to buy. You do not want to buy individual shares. Why it's not a good idea generally speaking to invest in individual stocks, but essentially the issue with investing in individual stocks is it's kind of risky. Like, yes, if you invest in something like Apple, chances are it's gonna be around 10 years from now. But historically there've been quite a few companies that people were like, "Oh my God, this is amazing. This is the thing to invest in." Then that company went bust. So you're automatically exposing yourself to more risk if you're investing in individual stock, also in general, like it's easy to say, hey, Amazon grew 10X in the last 10 years. Therefore it's gonna continue to do the same for the next 10 years. But that's trying to predict the future. The past is no real indication of future performance. So the advice that most people would give for beginners is that you should not invest in individual stocks.

8. What's an index fund?

You should invest in index funds. This is what Graham Stephan, one of my favorite YouTubers also says as well. He says, "The index funds are the best, safest, & easiest longterm investment strategy for most people." Which begs the question point number eight, what the hell is an index fund? So there's basically two bits to understand here there's the index bit & the fund bit, let's start with the fund bit. A fund is basically where investors will pool their money, so multiple investors would invest in the same fund. Then that fund would have a fund manager. The fund manager decides which companies the fund is gonna invest in. For example, let's say I were managing a fund & I called it Gringotts & let's say a hundred people from my audience decided to invest in my Gringotts fund. I as the fund manager can say, okay, the Gringotts fund now that we have a hundred people's money let's say it's a 100 million. So everyone's invested 1 million each I've now got a 100 million. I'm gonna put 20% of that in Apple, 10% in Facebook, 10% in Amazon, 10% in Tesla, 10% of Netflix 10% in Johnson & Johnson, all of that sort of stuff.

So you, the investor don't have to worry about this because you trust me & my fund Gringotts to manage your money. As you know, the fund performs well, because the prices of these stocks & shares increases you get the returns & I take a 1% or 2% management fee. So I make a load of money because I'm earning 1% or 2% off of this 100 million that I'm managing & you're not worrying about having to pick stocks yourself. You trust me as a seasoned professional to do that for you. So that's what a fund is.

Now, the index bit refers to a stock market index. So a stock market index would for example, be the FTSE 100 which is the a hundred biggest companies in the UK or the S&P 500, which is the 500 biggest companies in the U.S. or the NASDAQ or the Dow. These are all different indices of the stock market. & If we use the S&P 500, for example, these are the components of the S&P 500. So we said, it's the 500 biggest companies in the U.S. So number one is Apple & Apple makes up 6.5% of the S&P, Microsoft makes up 5.5, Amazon makes it 4.7, Facebook has 2.2, Alphabet, which is a Google makes 1.5 & 1.5 is about 3% of the total S&P 500. Essentially we've got these 500 companies if you go all the way down... Oh, Ralph Lauren is 496, but chances are, you've not really heard of many of the other ones at the bottom of the list but chances are, you've heard of most of the companies towards the top of the list. So the S&P 500 is an index of the U.S. stock market. If you look at the performance as a whole of the S&P 500, you get a general idea of how the U.S. economy is going as a whole, started in 1980.

Since that time this is what the us stock market has been doing. So as you can see, there is a general trend upwards but for example in 2000, there was a bit of a crash, in 2008 famously there was a bit of a crash. Earlier this year, when Corona was first starting to be a thing there was a bit of a crash but then the market basically immediately recovered after that. Okay, so we know what a fund is, i.e. a way of pooling money. We know what the index is, something like the S&P 500, when you combine those, you get an index fund which is a fund that automatically invests in all of the companies in the index.

So with me, for example basically most of my investments, all of my money is in the S&P 500, which effectively means that 6.5% of my investments are in Apple, 5.5 in Microsoft, 4.7 in Amazon, 2.2 in Facebook, 3% in Google, 1.5 in Berkshire Hathaway & so on. So why is this good? Well, it's good for a lot of reasons.

So firstly index funds are really, really easy to invest in. A big problem that beginners have to investing, it's like, well, how the hell do I know which company to invest in? How do I read a balance sheet? How do I do any of this stuff? If you invest in an index fund, you actually don't have to worry about any of that.

Secondly, index funds give you a decent amount of diversification. There are all sorts of companies in the S&P 500. So you're not entirely reliant on the tech sector or the oil sector or the clothing sector or anything to make the bulk of your money. You are very nicely diversified across all these U.S. companies.

Thirdly, index funds have very low fees. So because it's not a real person who is deciding what to invest in & doing all this research & trying to make loads of money is essentially a computer algorithm that automatically allocate your money based on the components of the index fund. The fees for those are really low. & one of the main things about investing for the longterm is that even a slight increase in your fees is gonna massively impact your financial upside.

So for example, an index fund with a 0.1% fee is so much better for you than an actively managed fund where a fund manager is charging you even 1% because the longterm difference between 0.1% fees & a 1% fee is sort of absolutely astronomical over the long term. Finally, if you look historically &, you know technically historical performance is not the same thing as future performance, but if you look historically very few funds have managed to actually consistently beat the market i.e. outperform the index. In fact, someone like Warren Buffett famously says that if you gave him a hundred thousand pounds & asked him to invest it right now he would just invest in an index fund, like the S&P 500. In fact, in 2008 Warren Buffett challenged the hedge fund industry to try & beat the market.

Warren Buffett said that hedge funds are a bit pointless because they charge way too high fees & they don't actually get the sort of returns they claim to get. So he set up this 10 year bet which this company called Protege Partners LLC accepted, where Buffett said that he was gonna bet that the index fund outperformed the actively managed fund. Warren Buffett ended up winning that bet & sort of gave lots of money for charity or something like that. But that just sort of goes to show that it's really hard to beat the market with an actively managed fund. Basically, no one can predict what the market is gonna do in the future. Therefore if you hit your ride on index, i.e. you're gambling on the entire market, rather than thinking, you know what I've got some amazing insight that I'll know exactly which 10 stocks to pick that are gonna beat the market. You might as well hit your ride with the whole market rather than individual stocks.

9. Isn't investing Risky?

Okay, so we've sorted out the problem of which stocks to invest in by completely circumventing the problem & instead, just investing in index funds. The next big question people usually have about investing in stocks & shares is the amount of risk. That brings us to point number nine. The argument usually goes as follows that, "Hey, okay cool. This investing in stocks & shares stuff. It sounds kind of interesting, but my uncle Tom Cobley, invested lots of money in the stock market. He lost a lot of money. My parents have told me that investing in the stock market is a really risky thing & I shouldn't do it. I should instead invest in real estate because real estate is safe."

That is usually the sort of thing, the sort of idea that people have about investing in stocks. Naturally there is the anxiety of what if I lose all my money. So let's talk about that now. So if we take a step back, the only way to lose money in anything is if you buy a thing & then you sell it for less than you actually bought it. Like, let's say you bought a house for 300,000 pounds, & then Brexit happens the next day & the house prices plummet. Now your house is only worth 250,000. At that point, if you decide to sell your house, then yes you are losing money & you've lost 50,000 pounds.

Equally, the only way to really lose money in stocks is if you buy a stock at a certain price & then you sell it for less than that price. So for example, let's say you bought shares in Apple on the 18th of February, 2020. Let's say you bought one share which time was $79 & 75 cents. Because this is your first time in investing you keep on looking at the price of the Apple stock because every time are you thinking, oh, have I made money, have I made money? Really annoyingly for you, you see that over the next kind of few days a few weeks, Apple stock is actually going down. Then on the 18th of March, 2020, you decide screw it. I'm gonna sell my one share on Apple, because I don't want to lose all my money. You sell it for a measly price of $61.67. So you technically lost $18 because you bought it at $79 in February, & you've sold it for $61 in March. Then you think, damn, I've lost 20% of my investment. This stock market thing is BS. I'm never gonna invest in the stock market again, & you call it a day.

This would be a very bad thing to do. Because for example, if we look at Apple stock price in March, it was $57.31 but if you just held onto your one Apple share in that time, what is it today? It's the 8th of October. Apple is now trading at $114.96. So if you just held on for a few months, you would actually made a lot of money. You would have bought it at $79 & within, I don't know eight months, it would now be worth $115. That's a pretty good game. So the real lesson here is that when you're investing in stocks & shares, & also when you're investing in real estate, these are longterm investments. Ideally, you shouldn't be putting any money into stocks & shares that you need to access within the next five years. Actually a lot of people would extend that to 10 years.

It's exactly like that with house prices, it's like if you buy a house as an investment, & then the houses house prices go down it would be completely stupid of you to sell the house unless you are absolutely desperate for the money, because something major has happened. Instead, if you just held onto the house then you would have made more money in the long run because in the longterm house prices always go up & in the longterm basically the stock market always goes up & that's a bit of, it can be a controversial statement, but for now take my word for it that over the long term, the stock market always goes up.

But having said that again, this is a longterm thing. For example, if we look at the S&P 500 & look at how it was in 2008 at the financial crash right around 2007, it's $1,500 per bit of the S&P 500. Then the crash happens & then by February, 2009, it's down to $735. So basically 50% of the value has been wiped off of the S&P 500. Now, if you bought it in 2007 & you saw it, you know, get a crushing & crashing & crashing, & then you sold when it was $800. Now, you've lost a lot of money because you bought high & you sold low.

But if you just held on, it took let's see, to June 2007 it's at 1500s, it takes about up until 2013. So it takes about five years for it to get back to its normal level. Even if you'd invested, like just before the crash & then your investment plummeted by 50%, if you would just held on you'd have bought in at the S&P 500 at 1500. Right now it would be $3,445. So since 2008, 2007, when he first invested over the last 13 years the S&P 500 has more than doubled. So you would have more than doubled your money, provided you did not panic sell when the market crashed.

Now, hypothetically could the market crashed down to zero & therefore you will actually lose all your money. Yes, it could, but if the us stock market crashed literally to zero i.e. all top 500 companies, including Apple, Google, Microsoft, Facebook, like literally every company in the top, in the S&P 500, all of those got destroyed overnight. The stock market crashed to zero. The world would be in some sort of mega apocalypse & you'd have a lot more serious problems to worry about rather than the value of your portfolio, of stock market indices on Vanguard. In that scenario, in that doomsday scenario money would stop meaning anything & you'd be using money to wipe your bum because money has no value because the stock market is completely crashed. It's basically unfathomable that the global economy could be so completely wrecked, such that every single company goes down to zero.

In my opinion, & again, you know, I'm not a financial advisor. This is technically not financial advice whatever that means, but in my opinion it's unrealistic to think that if I put my money in stocks & shares, I could lose all of it. There's basically no way you're ever gonna lose all of it provided you're diversified. If you invested in, I don't know, Myspace in 2000 & whatever it was, & then Myspace crushes & then you've lost all your money because, you know, they have no money, but if you invest in the top 500 companies in the U.S. or the top 500 companies in the world, or the top 100 companies in the UK, it is so vanishingly unlikely that you will ever lose your money. That I don't think that is a risk that we should even be thinking about. So realistic, worst case scenario, yes, investing in the stock market is risky in the short term, but if you're investing in the longterm, the market will always go up & you will always end up making more money in the long run provided you don't have to take money out at inopportune times.

10. When should I get started?

Okay, so at this point, we've established that investing in stocks is very good & investing in index funds is a relatively safe way of doing this. The next question is usually when should you get started? Like how old do you have to be? Is it ever too soon to start? Is it ever too late to start? Here the answer is pretty simple. Basically all investment advice agrees with me on this front. There's a very good website called The Motley Fool & they have a nice article explaining this. Basically, you should start investing as soon as possible. It doesn't matter how old you are. It doesn't matter how young you are. The earlier you start investing the better. There are three caveats though for like sensible financial advice.

Firstly, you wanna make sure that all of your high interest i.e. credit card debt is paid off, because when it comes to compounding even though gains compound, losses compound as well. So if you've got like a 6% credit card debt that's eating into your bottom line every single month you want to pay that off as soon as possible.

Point number two is that you want to make some sort of emergency fund. People usually say that your emergency fund should have in cash basically three to six months of living expenses so that if you lose your job or if you're hit with some kind of incredible medical emergency, & you're not in the UK where medical care is free, or you're in the U.S. or something like that, then you've got money to do that. You don't have to take money out of your investments.

Caveat number three is that you don't want to put any money into stocks that you think you might need to use in the next three to five years. So let's say you're 24 & you've just landed your first job. You're thinking of getting a mortgage & buying a house & you need money for the deposit. Do not put that money into the S&P 500 or into any kind of stocks & shares because no one can time the market. No one knows whether we might you know, there might be a market crash tomorrow. All we know is that in the longterm, the stock market goes up, but if you need to buy a house next year there is absolutely no guarantee that that money will still be worth exactly the same or worth more this time next year.

So provided those two conditions are met. Like firstly, you have no high interest credit card debt. Secondly, you've already got your emergency fund. Thirdly, you're not planning to gonna have a major expense in the next few years. At that point, absolutely everyone should be investing something into the stock market. In my opinion, whether you're 12 or 20 or 21 or 22 or 50, it doesn't matter. As they say on the market floor there is almost no way your future self will regret making the decision to invest.

As you know at this point, this is because of compounding. The more time you leave your money in the stock market, the more it compounds. There is a huge difference. There's like lots of interesting numbers about this on the internet that people have calculated that if you start investing at the age of 20, versus if you start investing at the age of 25 or 30, it makes such a huge difference to your bottom line. That basically, as soon as you read this article & hear about investing, you should start investing provided those three conditions that we talked about are met.

11. How much money do I need to get started?

All right, so we're nearly there. Now, we're point 11 out of 12 where we said, okay, you sold me on this idea of investing in index funds. All of these three conditions are met. I don't have a high interest credit card debt. I've got my emergency fund, or I'm a student. Therefore my parents are my emergency fund & I'm not planning to buy a house or a big thing in the next three years. The next question is usually how much money do I need to get started with investing?

For worst case scenario, "I'm 14 years old & I don't have any money. How do I get started with investing?" The answer here is again, quite easy, basically start with whatever you can. For some of these websites & some of these apps that you can use to invest in stock market indices. You can start with as little as $5 or 10 pounds, depending on the website. You might need to start with a 100 pounds or a 1000 pounds. You can research this & it kind of depends on which country you're in, but basically you want to start investing as soon as possible. It doesn't matter if it's a tiny amount of money to begin with.

Firstly, it's useful to invest small amounts of money because compounding is always good. But secondly & more importantly, the sooner you start investing the sooner it becomes a habit. So for me, for example, I started investing in 2018 with the advice of my dear friend with a family trust fund, Daniel Broutt. I knew absolutely nothing about it before then, but I really wish I'd started investing in like 2013 when I first had my first part time job because (a), that would have encouraged good financial habits within me. I would have kept aside maybe 10% or 20% from the top line to put into my investments. Secondly, it would have meant that investing became a habit. So I would have known about the fact that stock market indices exist. I would have done the research. I would have watched videos & read articles like this, although these weren't as abundant in 2013.

What I'm really annoyed about with myself is I started making actual money in like 2015 & 2021 when my first business started to do very well. Between 2015 & 2018, I did not invest any money just because I didn't know that you could, I didn't know how & I always kinda thought that, "Huh, I'm making money now." It's just sort of sitting in my bank account. I know that inflation is a thing. So I know my money's losing value but I just didn't think about investing & didn't realize how easy it is & that it's a thing. So I really wish I'd started investing my real money in 2015, but the only way I would've done that is if I had started investing from 2013, when I first started making, I don't know, fifteen dollars an hour during my part time job.

So again, & I can't state this emphatically enough. Like it doesn't matter if all you have is a small amount to invest even if it's one pound, even if it's $10. The process of making the account & researching online stockbrokers in your country & figuring out how to actually do this stuff is the most valuable thing that you could be doing with your time immediately after reading this article.

12. How do I begin?

Finally, point number 12 is okay, I'm sold, I've got a 100 pounds here & I want to put it inside a stock market index fund. How do I actually do that? The answer here is you want to find an online broker. So this will vary massively depending on which country you're in, because these online brokers as I said, have like zillions of laws they have to comply with & financial regulations & all this stuff. In the U.S. most people that I know use the Vanguard as well. My favorite blogger Mr. Money Mustache recommends that as well. Although in the U.S. there are also other services like Betterment, which I'd bet a few friends who use that as well. Again, depending on which country you're in, literally all you have to do is Google the phrase, best online broker, Germany, or best online broker, Iran, or best online broker, India, whichever country you're in.

You'll find something, read some reviews. Basically the thing you're looking for is you want to be able to invest in index funds & you want the fees to be as low as possible. I think Charles Stanley Direct the fee is 0.25% which was the lowest at the time when I made my account & I think is still pretty competitive. So you want the fee to be like a really, really, really small fraction of a percentage. Then once you've made your account & verified your identity & gone through all the hoops & stuff which sometimes takes a few days, & they send you a letter to the post to verify your address, like depending on what the regulations are. Once you've done that then you can start just putting money in here & there.

All my friends that I've spoken to about this stuff over the last, like couple years since I first started knowing about investing in things, they've all started making accounts & sort of making these investment accounts for themselves. For the first few weeks they all sort of compulsively check their phones to see what the stock market is doing. But then very quickly you realize that actually I'm investing for the long term here. I actually don't give a toss what the stock market is doing in the short term. I check my portfolio once every six months just cause sometimes I'm curious. I don't even bother looking at it.

This is very much a set it & forget it strategy, you're investing for the longterm. Your money will magically grow over time provided you don't touch it & think, "Oh crap, the stock market's going down a bit. I'm gonna take my money, because I can't handle these losses." There's loads more to say about investing in finance, but hopefully this was a reasonably concise, albeit not very concise. This is gonna be a long article, but well, hopefully this was a reasonable introduction to how to get started with investing in index funds.

Disclaimers

com.abitnbidgoli is a participant of multiple affiliate advertising programs designed to provide a means for sites to earn advertising fees by advertising. Having said that, I only curate/advise companies that reach my seal of approval & this is not financial advice, just my ponderings.

“10 ETERNAL TRUTHS OF THE GENTLEMANLY LIFE

- A gentleman says 'please' & 'thank you,' readily & often.

- A gentleman does not disparage the beliefs of others ~ whether they relate to matters of faith, politics, or sports teams.

- A gentleman always carries a handkerchief, & is ready to lend it, especially to a weeping lady, should the need arise.

- A gentleman never allows a door to slam in the face of another personmale or female, young or old, absolute stranger or longtime best friend.

- A gentleman does not make jokes about race, religion, gender, or sexual orientation; neither does he find such jokes amusing.

- A gentleman knows how to stand in line & how to wait his turn.

- A gentleman is always ready to offer a hearty handshake.

- A gentleman keeps his leather shoes polished & his fingernails clean.

- A gentleman admits when he is wrong.

- A gentleman does not pick a fight.

A gentleman knows how to make others feel comfortable.” ~ Curated Excerpt From: Thomas Nelson. “How to Be a Gentleman: A Timely Guide to Timeless Manners.” Apple Books.

Curated via Ali Abdaal. Thanks for reading, cheers! (with a glass of wine & book of course)

2019 Edict Rutherford Sauvignon Blanc

Producer: Edict Wines, Rutherford, Napa Valley, Napa County, North Coast, California, USA

"Our Rutherford Sauvignon Blanc is fragrant on the nose & platinum in the glass. There’s guava, lemon, gooseberry & tropical fruit to start, with hints of passionfruit & a variety of citrus behind the scenes. Bright, lifted & refreshing...exactly what we intended." ~ Edict Wines Winery

How to Be a Gentleman: A Timely Guide to Timeless Manners

How to Be a Gentleman: A Timely Guide to Timeless Manners is the revised and updated edition of the smash-hit How to Be a Gentleman and offers practical advice on being a gentleman in the twenty-first century. Slightly outdated with the technology, having said that the principles remain the same.

Should you take your BlackBerry on vacation? What is the best way to accept a compliment? Is an e-mail an acceptable means of writing a Thank-You note? While the tenets of gracious behavior never change, the situations a gentleman faces do and have changed significantly in the last ten years.

In this revised, updated, and expanded version of the bestselling How to Be a Gentleman, Bridges addresses new issues such as airport security, Bluetooth and BlackBerry usage, and appropriate internet and instant message communication.

Still featured are topics ranging from how to receive a compliment to how to act at funerals. Certain to be the must-have guide for the modern gentleman, this revised edition will echo the success of its predecessor.