Why NFTs are Valuable

Non-fungible tokens (NFTs) are digital assets that are provably unique, creating digital scarcity. They can't be duplicated or divided. They have many use cases, including for digital collectibles, music, artwork, & in-game tokens.

Cryptocurrencies, utility tokens, security tokens, privacy tokens… digital assets & their classifications are multiplying & evolving right alongside cryptographic & blockchain technology.

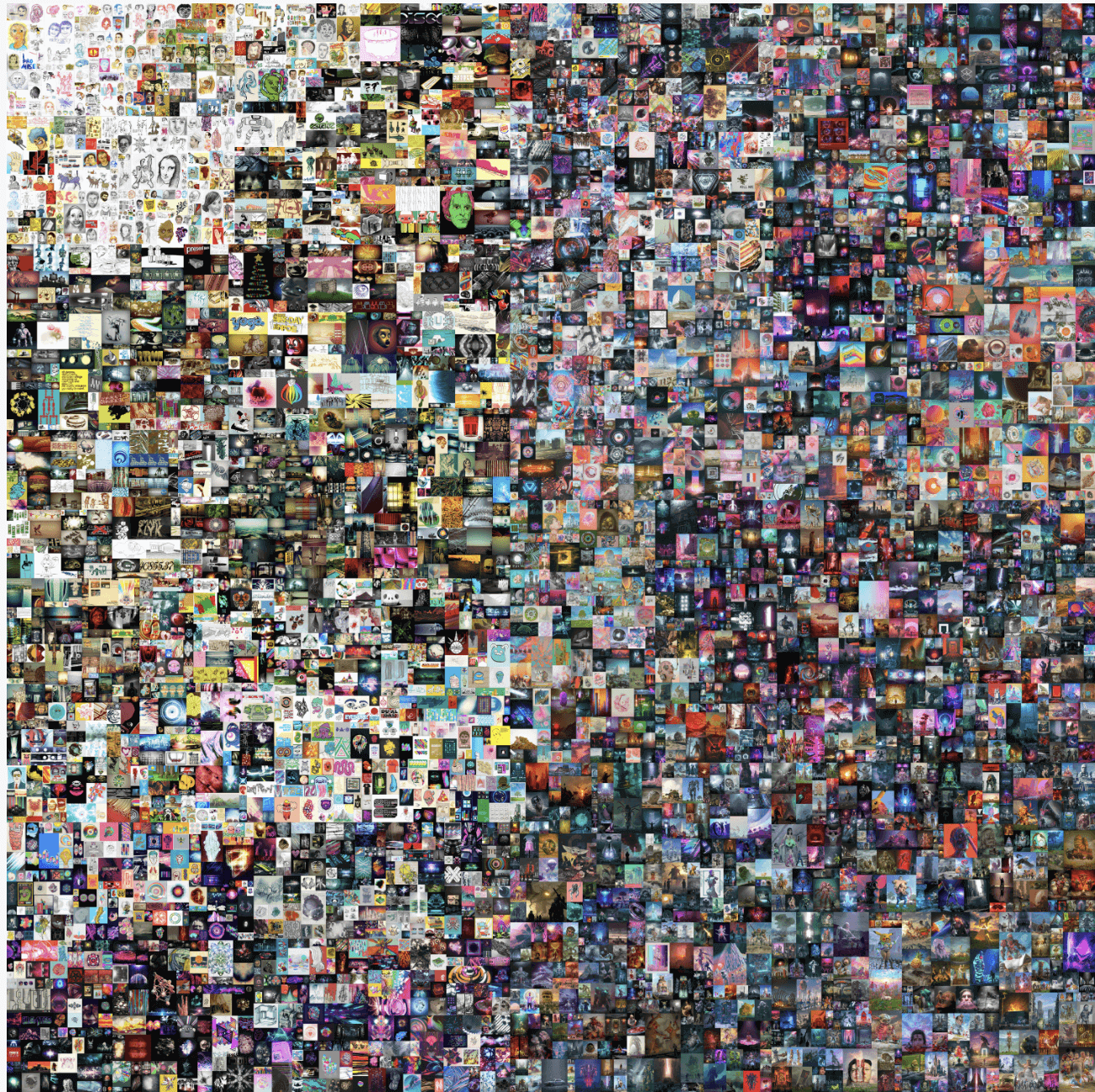

The Beeple "First 5,000 Days" NFT sold for $69,000,000. Naturally, that's raising some eyebrows around what the purchaser really bought. Obviously, the buyer doesn’t own the art in any traditional sense. Look, I can paste it right here:

Before you say “you can do that with a painting too!” That’s not quite true. A picture of a painting is different from the painting. The JPG of the First 5,000 Days piece is the piece. There’s no difference. This is one problem with the ownership debate around NFT art (intro for the unfamiliar). You don’t own the artwork the same way you might own an original Picasso. You can’t destroy it, you can’t modify it, you don’t really control it in any special way.

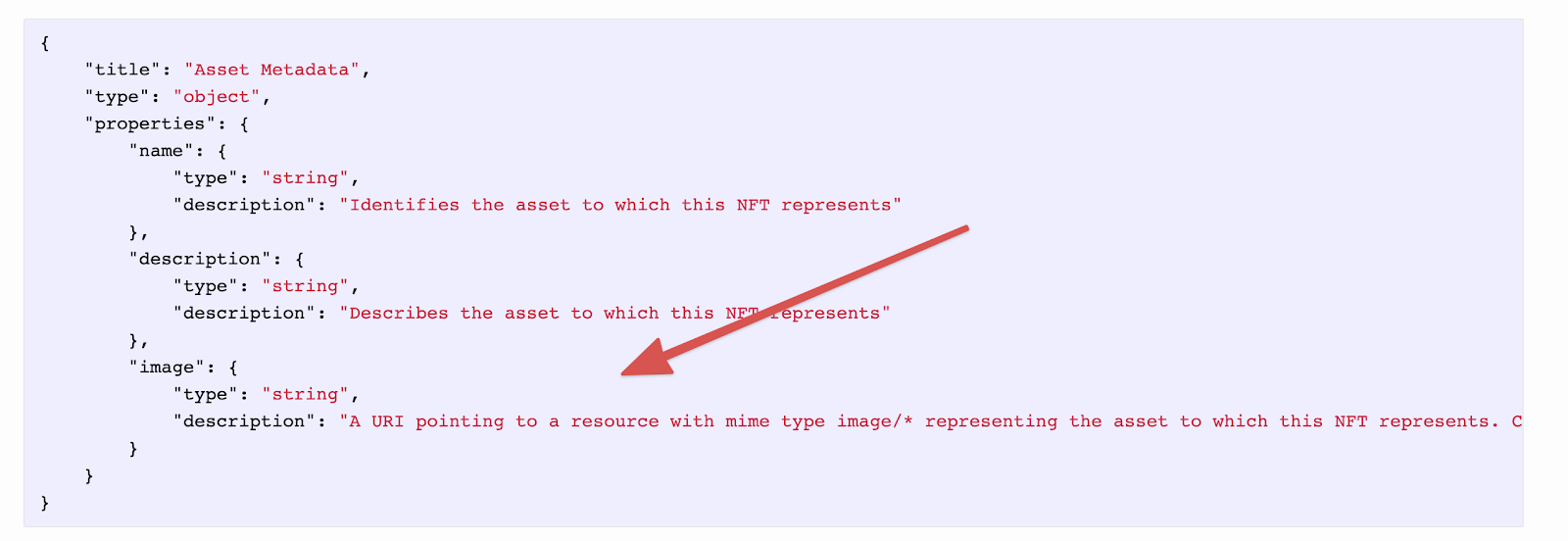

But that’s the thing with NFTs, you’re not buying the art. You’re buying the NFT. The NFT is not the art. It’s a few lines of codes that includes a reference to the art, but that’s it. The art doesn’t even live in the NFT since it would be way too much data to put on the Ethereum blockchain. All the NFT has is a link to where the art is!

I could go make another NFT of the exact same piece of art right now, & no one could really stop me. But it wouldn’t be worth anything. Why not? Well, for one, it wouldn’t have an authentic origin. It's extremely easy to verify whether an NFT came from Beeple or not. In fact, it's significantly easier to do this with NFT art than with “real world” art since everything on the Ethereum blockchain is legible. All Beeple would have to do is tweet the public address he's signing his art from & then anything of his that's signed by any other address we'd know is fake.

Origin as the source of value is nothing new. Kanye West can sell a t-shirt for $120 because he’s Kanye West. Imagine how much he could sell the white t-shirt he wore on stage for a show. It doesn’t matter that we can buy a t-shirt for $5. Origin matters. You might think of an NFT not as the art, but as the signature on the art. Historically you had to own the physical piece to have the signature. Now we can abstract the signature into its own asset, & you can buy the creator’s self-declared seal of authenticity.

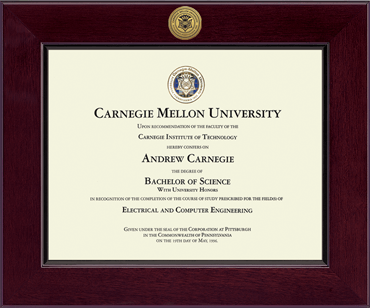

Another analogy here is a college degree. Tuition at Carnegie Mellon is $57,119 per year. At the end of four years, you receive a piece of paper. Is that piece of paper worth $228,476? You could just photoshop your name into this one & call it a day:

But it’s not the piece of paper, it’s the origin of the paper & what it tells people. The signature matters. It tells people you spent 4 years & enough money to save 65 lives from malaria learning… something. Hopefully. Therefore they should pay you more than the otherwise indistinguishable student a few miles away. The price of a degree is not about knowledge or the friends you made along the way. Those could be had for far less money. It’s about signaling. Signaling you were competitive & affluent enough to get into this institution, & then control your binge drinking well enough to last for four years.

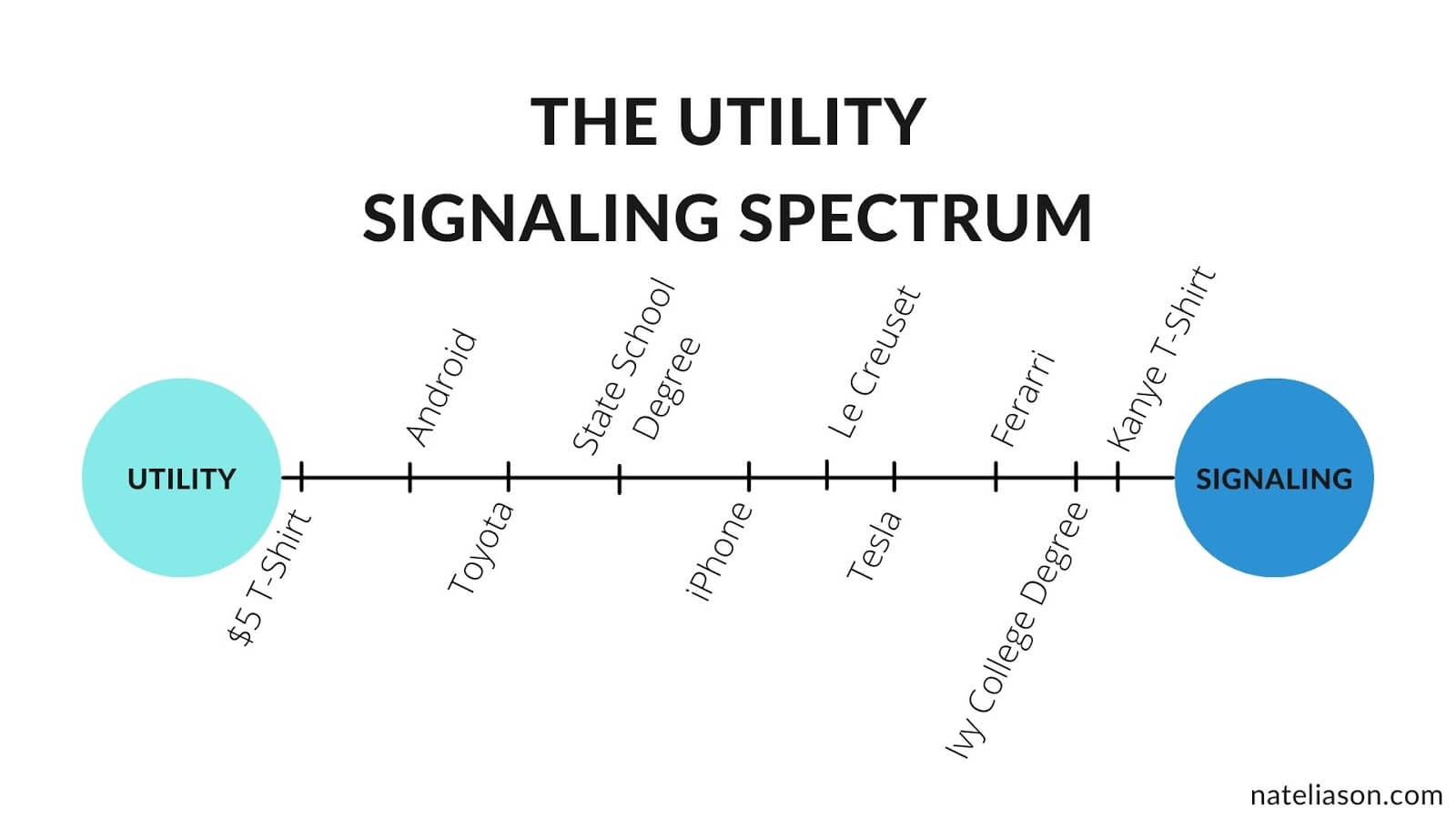

The college degree exists somewhere on the spectrum between “utility” & “signaling.” One fairly consistent truth with the utility to signal spectrum is that as things get more expensive, we usually find ourselves closer & closer to the signaling end of the spectrum. The $5 t-shirt is pure utility. The Kanye t-shirt is almost entirely signaling. Everything we buy, & own, falls somewhere on this utility to signaling spectrum.

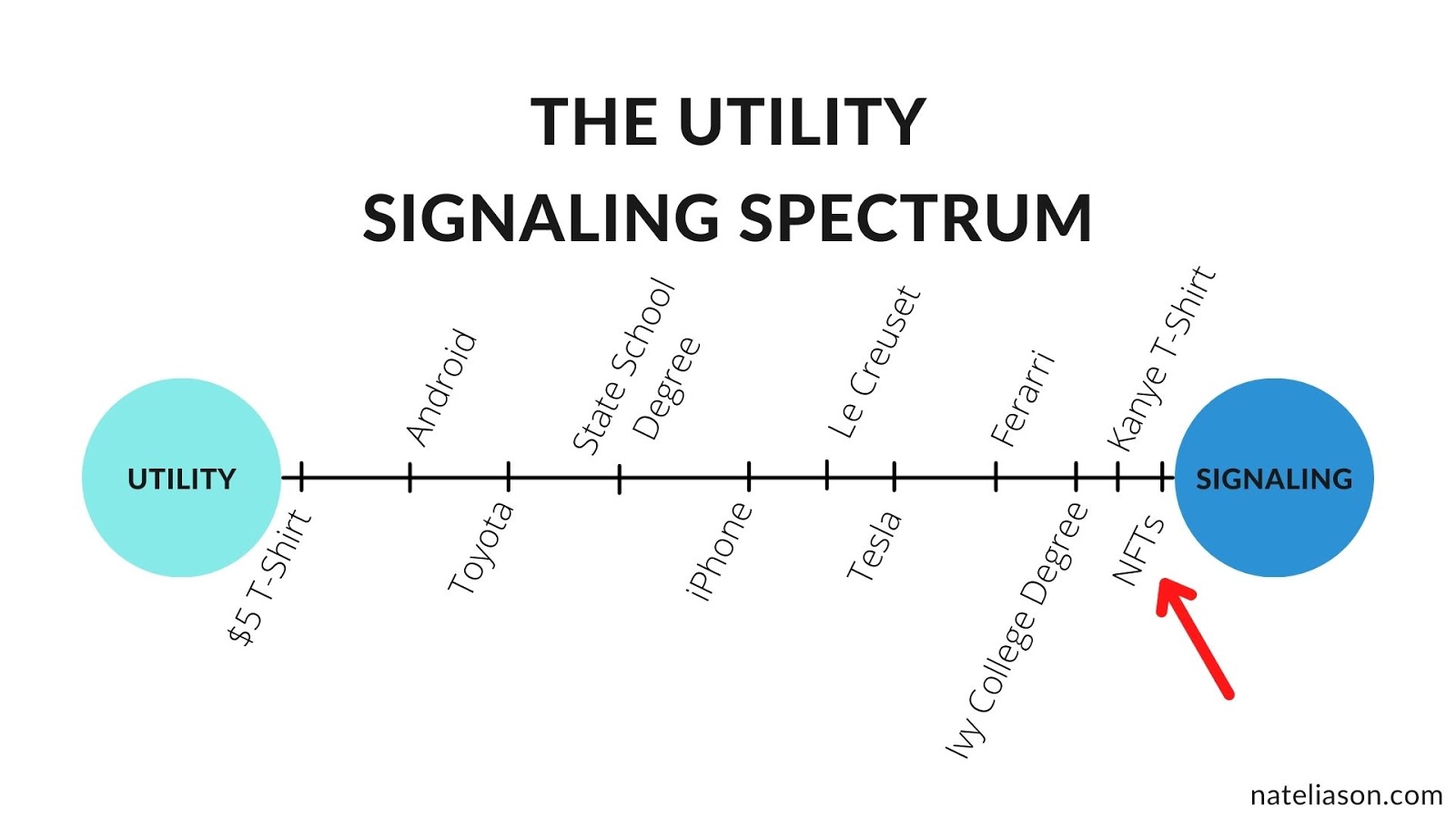

So where are NFTs right now? Right here:

NFTs are fascinating in part because they take the utility to signaling ratio to the extreme. There has never been something so valuable that’s so utterly useless. Tulips you could at least plant. There is effectively zero utility to owning NFTs that are on the market right now, besides speculation about their future value. So beyond speculation, why are they valuable? Signaling. There are some 240,000 single wallets with over $1m USD in Bitcoin. If you suddenly came into a few milly, you’d wanna show off too. NFTs are a fun new way to signal wealth & taste.

But they’re also a way to signal how early you are in the crypto economy. If you buy into the idea that NFTs will set a new standard for digital rights management & digital ownership (which I do, more on that next time), buying some now is kind of like buying BTC back in 2013 or registering a 3-letter domain name in the early days of the web.

And to be clear, I absolutely love NFT technology & am going to write about it much more. I’m not pointing out their high signal to utility ratio to criticize them. I’m pointing it out because I think they’re being unfairly criticized for being a waste of money. Signaling is extremely valuable, & NFTs are a fascinating new way to peacock & maybe get rich along the way.

So are NFTs a bubble? I doubt it. NFTs are getting lots of press but the market is still minuscule in the grand scheme of things. The art market is worth ~ 67 billion dollars. The NFT market only hit 338 million in 2020. Maybe it’ll hit a few billion this year. But then factor in how much easier it is to buy NFTs than art, & how many other industries NFTs could eat away at, & that 67 billion number just sounds like a starting point. For example, sports merchandise. Some of the money getting spent on NBA merch is now flowing into TopShot. TopShot has done at least a few hundred million in transactions so far, which sounds insane until you remember that NBA merchandise, which has no speculative investing component, is a nearly 50 billion dollar industry.

Or compare NFTs to other crypto options. Bitcoin’s market cap is over 1 trillion. If there were a Beeple-sized, $69m sale every single day for a year, the NFT market would still be only $25b, or 2.5% of the Bitcoin market. It is EARLY. While I don't think NFTs are a bubble, I think there are much more interesting use cases for NFTs that aren't being done yet. Uses that will take them beyond mere signaling, & give them some new forms of utility that weren't previously possible online. Once we start seeing more of those use cases arrive, the market will just continue to grow.

“Live steady. Don’t fuck around. Give anything weird a wide berth ~ including people. It’s not worth it. I learned this the hard way, through brutal overindulgence.

& it’s also a nasty fact that I have to catch a plane for Chicago in three hours ~ to attend some kind of national Emergency Conference for New Voters, which looks like the opening shot in this year’s version of the McCarthy/Kennedy uprising in ’68 ~ & since the conference starts at six o’clock tonight, I must make that plane…

… Back to Chicago; it’s never dull out there. You never know exactly what kind of terrible shit is going to come down on you in that town, but you can always count on something. Every time I go to Chicago I come away with scars.” ~ Curated Excerpt From: Thompson, Hunter S. “Fear & Loathing on the Campaign Trail '72.” Apple Books.

Curated via Nat Eliason. Thanks for reading, cheers! (with a glass of wine & book of course)

2018 Magnolia Cabernet Sauvignon

Producer: Krutz Family Cellars, Sonoma Coast, Sonoma County, North Coast, California, USA

"Produced from 100% Cabernet Sauvignon & aged in French oak for 10 months, 35% new, the 2018 Cabernet Sauvignon Magnolia sports a deep garnet-purple color & alluring notions of baking spices, warm plums, Morello cherries & black raspberries with a waft of pencil lead. Medium-bodied, soft, juicy & plush, it delivers mouth-coating, vibrant black fruits with an herbal lift on the finish. 4,000 cases were made." ~ 90 Points ~ Lisa Perrotti-Brown ~ Robert Parker's Wine Advocate

"A beautiful expression of Sonoma County Cabernet Sauvignon. Deep purple in color with a medium-full body that is well balanced & approachable. Silky smooth tannins balance the black cherry, juicy plum, & subtle oak characteristics. There is a freshness to the finish that invites another approach." ~ Krutz Family Cellars Winery

Fear and Loathing on the Campaign Trail '72

From the legendary journalist and creator of “Gonzo” journalism Hunter S. Thompson comes the bestselling critical look at Nixon and McGovern’s 1972 presidential election.

Forty years after its original publication, Fear and Loathing on the Campaign Trail ’72 remains a cornerstone of American political journalism and one of the bestselling campaign books of all time.

Hunter S. Thompson’s searing account of the battle for the 1972 presidency ~ from the Democratic primaries to the eventual showdown between George McGovern and Richard Nixon ~ is infused with the characteristic wit, intensity, and emotional engagement that made Thompson “the flamboyant apostle and avatar of gonzo journalism” (The New York Times).

Hilarious, terrifying, insightful, and compulsively readable, Fear and Loathing on the Campaign Trail ’72 is an epic political adventure that captures the feel of the American democratic process better than any other book ever written.